As a proven investor who has created hundreds of billions in value for his shareholders since 1965, Warren Buffett has delivered the most spectacular performance of any investor in modern history. Yet remarkably, Buffett has no qualms about sharing the “secrets” to his success. For example, in his latest letter to Berkshire Hathaway shareholders released in February 2015, Buffett reflected on investing lessons he and Vice Chairman Charlie Munger learned during the last 50 years leading the firm, offering tactical pieces of advice relevant to investors at all sizes and stages.

As a proven investor who has created hundreds of billions in value for his shareholders since 1965, Warren Buffett has delivered the most spectacular performance of any investor in modern history. Yet remarkably, Buffett has no qualms about sharing the “secrets” to his success. For example, in his latest letter to Berkshire Hathaway shareholders released in February 2015, Buffett reflected on investing lessons he and Vice Chairman Charlie Munger learned during the last 50 years leading the firm, offering tactical pieces of advice relevant to investors at all sizes and stages.

So when one of the most successful investors of all time so openly gives you a glimpse into the inner workings of his success, you’d be wise to pay attention. But why do most other funds ignore Buffett’s investing strategies despite their successful track records?

In my view, a great deal of this is explained by incentive misalignment between hedge fund and activist investors who are investing other people’s money for large fees and short-term gains, versus Buffett who charges no fees to his investors and invests 99 percent of his wealth alongside them. While some hedge funds make it big in the short-term, they usually cannot sustain their success. It seems to explain why all the pressure from traders, hedge funds, and their academic partners is on the short-term gains — which ultimately led to the 2008 financial collapse.

Berkshire Hathaway’s success is due, in part, to Buffett’s willingness to avoid playing the short-term financial game. Buffett has said that his preferred holding period is forever. In the 2015 letter to shareholders, Munger wrote that Buffett would “deploy most cash not needed in subsidiaries after they had increased their competitive advantage, with the ideal deployment being the use of that cash to acquire new subsidiaries.” In short, Buffett did not want cash back from a business until it had both increased its competitive advantage and considered good-fit strategic acquisitions.

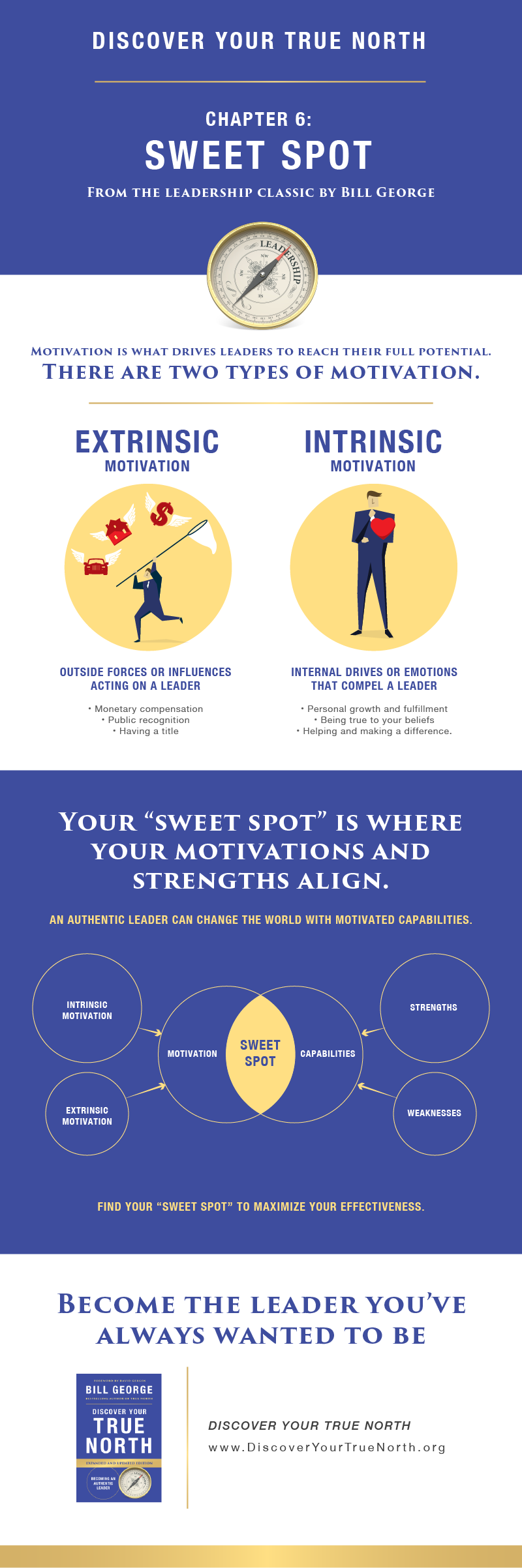

On Wall Street, where failure to produce short-term results often leads to termination, Buffett has been able to rise above this pressure to build a transparent, values-based company dedicated to upholding the highest levels of business ethics and personal integrity. How? Buffett operates in his “sweet spot,” a term I describe in my new bookDiscover Your True North as the intersection of one’s extrinsic and intrinsic motivations and greatest strengths.

Claremont professor and pioneer in psychology Mihaly Csikszentmihalyi, has given the following advice about motivation: “Find out what you are good at and what you like to do.” When you uncover opportunities that appeal to your motivations and utilize your strengths, you discover your sweet spot and will be most effective as a leader. Buffett’s success lies in a conscious decision to design his life to take advantage of his strengths and focus on his motivations. Clearly, Buffett’s strength is investing. His passion for the trade began when he was a young child. At the age of 11, Buffett made his first stock investment in three shares of Cities Service Preferred at $38 a share. Despite the stock dropping quickly to $27, Buffett held on and sold when the stock reached $40.

In his first full-time job as a stockbroker, Buffett felt conflicted because he could only generate commissions by pushing clients to trade actively, even when it was against their best interest. Rather than learning the tricks of the trade, Buffett invested his time in learning how to fundamentally analyze stocks. In 1954, Buffett took a position as apprentice to The Intelligent Investor author Benjamin Graham, without even asking the salary. When Graham decided to retire two years later, Buffett returned to his hometown of Omaha, Nebraska to open his own investing firm at the age of 26. This bold move positioned Buffett at the intersection of his motivations and his greatest strengths — his sweet spot.

Extrinsically, Buffett is motivated by being valued and gaining public recognition that allows him to raise his profile and gain access to deals. He is not motivated by material possessions. He still lives in the Omaha house he bought for $31,500 in 1956, eats simple meals at his favorite restaurant Gorat’s, and drives a 2014 Cadillac XTS that he bought after he sold his 2006 Cadillac DTS in a charity auction. Intrinsically, Buffett is motivated by learning and sharing his knowledge, as evidenced by his candid and educational Berkshire Hathaway letters to shareholders.

As a result of Buffett’s philosophy, Berkshire Hathaway’s returns have more than doubled the S&P 500 Index for the past 40 years. To put that success in context, Buffett has created twice the shareholder value of Goldman Sachs and Morgan Stanley combined with 24 people in a 5,000 square foot office in Omaha.

Buffett asks his partners, “Do you love the business, or do you love the money?” He only wants those who love the business.

This article was originally posted 9/29/15 on HuffingtonPost.com.

How well do you know yourself? How deeply do you understand your motivations?

How well do you know yourself? How deeply do you understand your motivations?

The following is an excerpt from Daniel Goleman’s new collection,

The following is an excerpt from Daniel Goleman’s new collection,  Don’t expect the same Q&A with Bill George on other podcast interviews. We don’t go by the talking points provided by the publisher. True North, originally based on first-person interviews with 125 leaders, became a must-read business classic when it was first introduced in 2007. Today, authenticity has become a key issue in the C-Suite, boardroom, in HR and recruiting initiatives, corporate communications, marketing campaigns, and of course, politics.

Don’t expect the same Q&A with Bill George on other podcast interviews. We don’t go by the talking points provided by the publisher. True North, originally based on first-person interviews with 125 leaders, became a must-read business classic when it was first introduced in 2007. Today, authenticity has become a key issue in the C-Suite, boardroom, in HR and recruiting initiatives, corporate communications, marketing campaigns, and of course, politics. Are companies and their boards succumbing to short-term pressures from shareholders?

Are companies and their boards succumbing to short-term pressures from shareholders?